Model Q® Roth Conversion Calculator

What is the Model Q® Roth Conversion?

Turn Taxable Retirement Accounts Into Tax-Free Income

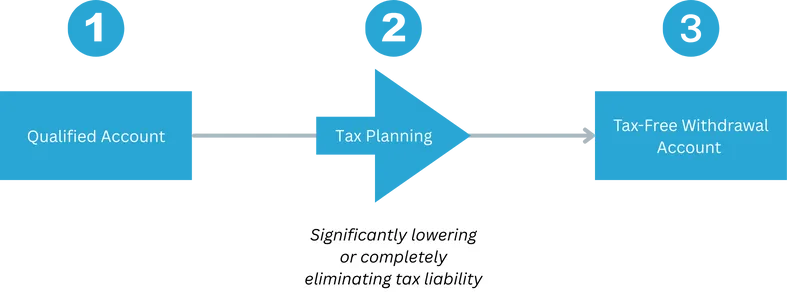

The Model Q® Roth Conversion Strategy is a tax-optimized approach to retirement planning that transforms your taxable retirement savings into a long-term, tax-free income stream. This diagram breaks it down simply:

1. Qualified Account

This is your current retirement account — like a Traditional IRA, 401(k), or SEP IRA — where taxes are deferred until you start withdrawing. Without planning, every distribution could trigger a hefty tax bill.

2. Tax Planning

Using our Q Tax Plan, we aim to minimize or completely offset the tax hit during conversion.

3. Tax-Free Withdrawal Account

Once converted, your funds grow tax-free — and future withdrawals are 100% income-tax-free. This means:

- No Required Minimum Distributions (RMDs)

- No taxes on gains

- Greater control over your income in retirement

The Model Q® Roth Conversion Strategy offers a clear path from tax-deferred to tax-free — without the shock of a massive tax bill. By planning ahead, you can keep more of what you’ve earned, eliminate Required Minimum Distributions (RMDs), and enjoy total control over your retirement income.

If you're serious about building a tax-free future, it’s time to explore how this strategy could work for you.

Let’s make your retirement as tax-efficient as it is fulfilling.